Clover

Cloud-based POS system and payments platform for retail, restaurant, and service businesses. Clover combines purpose-built terminals and mobile devices with cloud management, inventory, employee management, reporting, and an app marketplace for third-party integrations.

What is clover

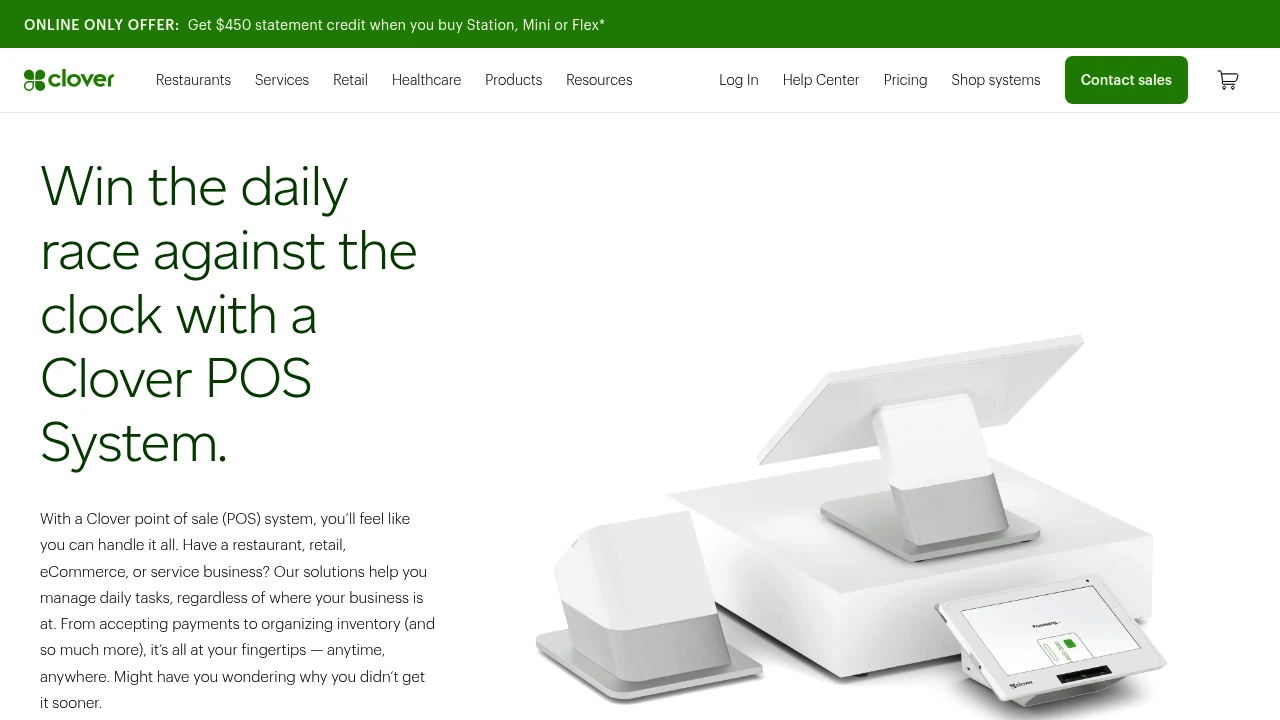

Clover is a point-of-sale and payments platform that combines merchant hardware, cloud software, and an app marketplace to run transactions, manage inventory, schedule staff, and analyze sales. The product family includes countertop and mobile terminals, card readers, and a centralized web dashboard for multi-location management. Clover is commonly sold through integrated payments providers and reseller partners who also provide merchant services and payment processing.

Clover is designed for a range of merchant types — retailers, quick-service and full-service restaurants, salons and service providers, and professional services — where on-site payment acceptance and local device functionality are important. It supports EMV chip, contactless (NFC) payments, gift cards, loyalty programs, and receipts, while connecting to back-office tools like accounting and e-commerce platforms.

Clover organizes functionality across device software, an administrative web console, and an app market that lets businesses add features such as online ordering, advanced inventory, employee scheduling, and accounting sync. Because Clover is distributed through payment partners, contract terms for processing and some hardware offers can vary by reseller.

Clover features

Clover’s feature set spans core POS functions, payments, hardware management, and extensibility through third-party apps. The platform is structured around a few primary areas: transaction processing and payments, order and inventory management, customer engagement, employee and shift management, reporting and analytics, and integrations via the Clover App Market and APIs.

Key device and software features include integrated card processing, EMV and NFC acceptance, on-device tipping and signatures, split checks, quick items and modifiers for restaurants, barcode and SKU-based retail sales, and support for gift cards and store credit. The web dashboard centralizes item catalogs, pricing, tax rules, and hours for multi-location businesses.

Clover also exposes an app ecosystem that lets merchants install solutions for loyalty programs, subscription billing, e-commerce sync, payroll, and accounting. The App Market covers built-in Clover apps and third-party solutions; merchants can pick apps by use case and install them directly to their Clover device for immediate access.

What does clover do?

Clover processes in-person and card-not-present payments while providing the POS user interface on purpose-built hardware or mobile devices. It handles itemized transactions, discounts, taxes, tips, refunds, and end-of-day settlement reporting. For restaurants, Clover supports order routing, kitchen printers, and order modifiers; for retailers, it supports barcode scanning and inventory tracking.

Beyond basic transactions, Clover provides tools for managing employees (time clock, roles, permissions), tracking sales and labor costs, running sales reports, and creating simple marketing programs like email receipts and offers. The device-centric approach lets staff ring sales without switching between multiple apps, and the administrative console gives managers remote control over menus, pricing, and permissions.

Clover’s ecosystem approach means many additional capabilities are available via apps: advanced loyalty, online ordering and delivery routing, appointment scheduling, integrated payroll, accounting sync to QuickBooks, and inventory replenishment. This extensibility allows merchants to scale functionality as their needs evolve without ripping out existing hardware.

Clover pricing

Clover offers these pricing plans:

- Free Plan: $0/month with basic register features, limited app installs, and standard reporting

- Starter: $9.95/month per device with additional reporting, basic employee management, and priority support

- Professional: $39.95/month per device with advanced inventory, multi-location reporting, and expanded app allowances

- Enterprise: Custom pricing for large merchants with multi-location deployments, advanced integrations, and dedicated account services

Clover hardware is sold separately and can be purchased outright or bundled by payment resellers; bundles typically include devices like the Clover Station, Clover Flex, Clover Mini, or card readers and may have one-time hardware costs plus installation fees. Transaction processing fees are typically charged by the merchant services provider and vary by reseller, contract type, and card acceptance methods. Check Clover's current pricing tiers for the latest rates, hardware bundles, and reseller offers.

Because Clover is commonly provisioned through payments partners, some features and pricing (especially transaction rates and hardware discounts) will differ between resellers. Merchants should compare monthly software fees, hardware purchase or lease terms, terminal replacement policies, and the effective interchange rates or flat processing fees offered by their merchant account provider.

How much is clover per month

Clover starts at $0/month for the basic register-style offering on a single device for merchants who need a simple, low-cost entry point. Paid subscription tiers for advanced features typically range from low‑double-digit to mid‑double-digit $ amounts per device per month depending on the level of reporting, multi-location features, and app allowances.

Subscription billing can be monthly or annual depending on the reseller; hardware leases or bundled pricing will affect the monthly cost when a merchant chooses financed terminal options. Processing fees are separate and charged per transaction by the payments provider.

How much is clover per year

Clover costs $0/year for the Free Plan on a single device, excluding hardware and transaction fees. Paid plans billed annually will multiply the monthly per-device fees by 12 and may include discounts for annual commitments; for example, a $39.95/month plan would amount to $479.40/year per device.

Annual costs for a live Clover deployment should account for hardware purchases (one-time), optional hardware warranties, software subscriptions, payment processing fees, and app subscriptions that may bill separately. Confirm the annual totals with the vendor or reseller when evaluating a proposal.

How much is clover in general

Clover pricing ranges from $0/month to custom enterprise pricing and includes one-time hardware costs plus transaction fees. A typical small merchant budget will include a single-device plan (free to low monthly fee), a one-time handheld or countertop terminal purchase ($100 to $1,500 depending on model), and variable processing costs that depend on card mix and contract terms.

Total cost of ownership should include: Hardware costs: purchase or lease of terminals and peripherals; Processing costs: interchange and processor markups; Subscription fees: monthly software tiers and app subscriptions; and Support and warranty: optional coverage or reseller support plans.

What is Clover used for

Clover is used to accept payments and run point-of-sale operations across retail, restaurant, and service businesses. Merchants use it to ring sales, manage inventory, process returns, accept contactless and EMV payments, and reconcile daily totals. The device-based interface is optimized for fast checkout workflows and can be tailored with apps for industry-specific needs.

Common operational uses include: setting up product catalogs with SKUs and modifiers, splitting bills and managing tips in restaurants, managing appointments or classes for service providers, and issuing gift cards and loyalty credits. Multi-location merchants use the web dashboard to aggregate sales, standardize pricing, and push menu or product updates to all terminals.

Clover is also used as a platform for adding third-party functionality without replacing hardware — for example, adding an e-commerce connector, advanced inventory plugin, or loyalty program via the App Market. This makes Clover suitable for merchants who want an integrated device experience with extensible capabilities.

Pros and cons of Clover

Pros:

- Integrated hardware and software platform reduces integration complexity and provides a consistent user experience across devices.

- App Market enables add-on functionality for niche use cases (loyalty, payroll, accounting sync, online ordering).

- Strong in-person payment features including EMV and contactless acceptance, on-device tipping, and receipts.

- Centralized web dashboard supports multi-location management and standardization of items and prices.

Cons:

- Pricing and processing rates are often tied to reseller agreements, which can make direct price comparison difficult and lead to varying merchant costs.

- The device-centric model can be less flexible than tablet-based or purely cloud POS systems for some advanced customizations.

- Some advanced features require paid apps or higher-tier subscriptions, increasing total cost of ownership.

- Hardware options and merchant accounts are commonly sold through partners, so support and contract terms vary.

Operational considerations include the tradeoff between convenience of an integrated device ecosystem and vendor lock-in for some peripheral or software choices. Merchants should evaluate reseller contracts and the availability of third-party app solutions for the specific workflows they need.

Clover free trial

Clover does not typically offer a platform-wide free trial the way SaaS-only vendors do, because the solution is delivered with hardware and through reseller merchant services. However, some resellers provide demo hardware, sandbox access through developer accounts, or trial periods for specific paid apps in the App Market.

If you're evaluating Clover, request a live demo on a reviewer or merchant terminal to test key workflows such as sale entry, tip capture, refunds, printing, and kitchen routing. Some resellers will provide a short-term hardware trial or money-back guarantee as part of a bundled offer — verify those policies before committing.

Developers and integrators can test APIs and apps using the Clover developer environment and sandbox credentials, which lets you simulate transactions and app behavior without live processing. See the Clover developer portal for details on getting a sandbox environment and testing endpoints.

Is clover free

Yes, Clover offers a Free Plan for a basic register experience on a single device, but hardware and processing fees still apply. The free software tier includes essential register functions and limited app access, making it suitable for merchants who want minimal monthly software expense.

For additional functionality — such as advanced inventory, multi-location reporting, or premium apps — merchants will typically move to a paid subscription tier or purchase apps from the Clover App Market, which increases monthly or annual costs.

Clover API

Clover provides a developer-focused platform with RESTful APIs, webhooks, and SDKs that allow partners and developers to build apps that run on Clover devices or integrate Clover data with external systems. The developer platform is designed for common integrations like accounting sync, e-commerce, analytics, and custom reporting.

Primary API capabilities include access to merchant catalogs (items, modifiers, categories), orders and payments, employees and shifts, customers, and devices. Webhooks notify external systems about events such as new orders, payments, or inventory changes so partner systems can react in near real time.

Clover’s app architecture supports both on-device apps (that merchants install from the App Market to run on terminals) and cloud-hosted integrations that use OAuth-style authentication to access merchant data. SDKs and documentation cover authentication, rate limits, and the permission model necessary to build compliant apps.

For implementation details, sample code, and sandbox access consult the Clover developer documentation which includes API references, SDK downloads, and guides for common integration patterns.

10 Clover alternatives

- Square — Simple, mobile-first POS with integrated payments, strong e-commerce and invoicing features suitable for small merchants.

- Toast — Restaurant-focused POS with sophisticated order routing, kitchen display systems, and table management for multi-station restaurants.

- Shopify POS — Retail-centric POS that tightly integrates with Shopify’s e-commerce and inventory management for omnichannel merchants.

- Lightspeed — Feature-rich POS for retail and hospitality with advanced inventory management and B2B capabilities.

- Vend — Retail POS known for easy inventory management and multi-store capabilities (now part of Lightspeed).

- Revel Systems — iPad-based POS geared toward enterprise and multi-location retail and restaurants with extensive customization.

- Upserve — Restaurant management platform that combines POS with analytics, reservations, and loyalty tools.

- Square for Restaurants — A variant of Square tailored for food-service workflows with built-in menu and floor management.

- Heartland Retail — POS and payments platform focused on independent retailers with integrated payments.

- PayPal Zettle — Lightweight hardware and POS offering that integrates with PayPal merchant accounts for simple payment acceptance.

Paid alternatives to Clover

- Square: Comprehensive POS and payments with predictable pricing and strong mobile support. Better for merchants prioritizing low friction e-commerce and invoice features.

- Toast: Deeply focused on restaurants with features like kitchen routing, delivery integrations, and menu engineering. Typically higher upfront hardware costs but richer restaurant functionality.

- Shopify POS: Best for merchants who already use Shopify for online sales and need unified inventory and customer records across channels.

- Lightspeed: Advanced inventory management and B2B ordering functionality suitable for complex retail operations and multi-location retailers.

- Revel Systems: Highly customizable enterprise POS with extensive integrations and deployment services for larger organizations.

Open source alternatives to Clover

- Odoo: Comprehensive open source ERP with POS module; flexible and extensible but requires more implementation work and hosting.

- uniCenta: Open source POS focused on retail and hospitality with offline capability and broad hardware support.

- Chromis POS: Java-based open source POS suitable for small retailers and cafés; lightweight and customizable by technical teams.

Frequently asked questions about Clover

What is Clover used for?

Clover is used for point-of-sale transactions and business operations management. It handles in-person payments, itemized sales, receipts, inventory basics, employee time clocks, and reporting. Merchants also use Clover to extend functionality through apps for loyalty, e-commerce sync, and accounting integration.

Does Clover integrate with QuickBooks?

Yes, Clover can integrate with QuickBooks through marketplace apps. Several third-party apps sync sales, taxes, and payment deposits to QuickBooks Online or Desktop. Merchants should review app capabilities and mapping behavior to ensure accounting data aligns with their bookkeeping practices.

How much does Clover cost per device per month?

Clover starts at $0/month for the basic register tier, with paid subscription tiers typically starting in the low double-digit $ amounts per device per month for advanced features. Hardware costs and payment processing fees are charged separately and vary by reseller.

Can Clover process contactless payments?

Yes, Clover supports EMV and contactless NFC payments. Most Clover devices accept chip cards and mobile wallets like Apple Pay and Google Pay, and they comply with standard payment security practices to process these payment types at the terminal.

Is Clover suitable for restaurants?

Yes, Clover can be configured for restaurant use. It supports table management, split checks, kitchen printers, order modifiers, and tipping workflows. For full-service restaurant needs, merchants often add restaurant-specific apps from the App Market or choose restaurant-focused hardware bundles.

Can I use Clover offline?

Yes, Clover devices have limited offline functionality. Devices can typically record orders and accept card-present transactions when offline, then batch-send transactions when connectivity is restored; however, functionality and reliability depend on the device model and payment processor. Always confirm offline behavior with your reseller.

How secure is Clover?

Clover uses industry-standard security for payments and data. Devices support EMV chip and NFC payments; data in transit is encrypted and the platform adheres to PCI-compliant practices. Specific certifications and security details are provided by Clover and payment partners; review Clover's security information for current details.

Does Clover offer an app marketplace?

Yes, Clover offers an App Market for add-on functionality. Merchants can install apps for loyalty, accounting, payroll, online ordering, and more directly to their devices. The App Market allows businesses to extend core features without building custom integrations.

Can I customize receipts and reports on Clover?

Yes, Clover allows customization of receipts and reports. Merchants can modify receipt layout, include logos, itemize tax details, and access a range of sales and labor reports via the web dashboard. For advanced reporting, third-party analytics apps or exports to BI tools are common.

Does Clover provide APIs for developers?

Yes, Clover provides REST APIs, SDKs, and webhooks for integrations. Developers can access items, orders, payments, employees, and device endpoints to build on-device apps or cloud integrations. Use the Clover developer documentation to find API references and sandbox access.

### clover careers

Clover is part of a larger payments and commerce ecosystem; careers related to Clover include roles in product management, hardware engineering, software development, partner integration, and merchant services. Opportunities are available both at the company behind Clover and among reseller partners and ISVs who build apps for the platform.

Companies hiring for Clover-related roles often look for experience in payments, POS systems, embedded hardware, iOS/Android development for device apps, and knowledge of PCI and payment security standards. For up-to-date listings, search the parent company’s careers page and reseller job boards.

### clover affiliate

Clover offers partner and reseller programs rather than a traditional consumer affiliate program. Payment processors and software vendors may become certified resellers or integration partners; these partners often receive co-marketing resources, device discounts, and technical support to provision Clover systems for merchants.

If you represent a software product or payments business and want to resell or integrate with Clover, review the partner information on Clover’s site or contact their partner team through the developer portal.

### Where to find clover reviews

Merchant and industry reviews are available on business software review websites, payments industry blogs, and marketplace listings. Search aggregators like G2, Capterra, and Trustpilot for user reviews that cover hardware reliability, support experiences, processing rates, and app ecosystem effectiveness. Also review case studies and partner testimonials published on Clover’s official site to see vendor-led success stories.