Highradius

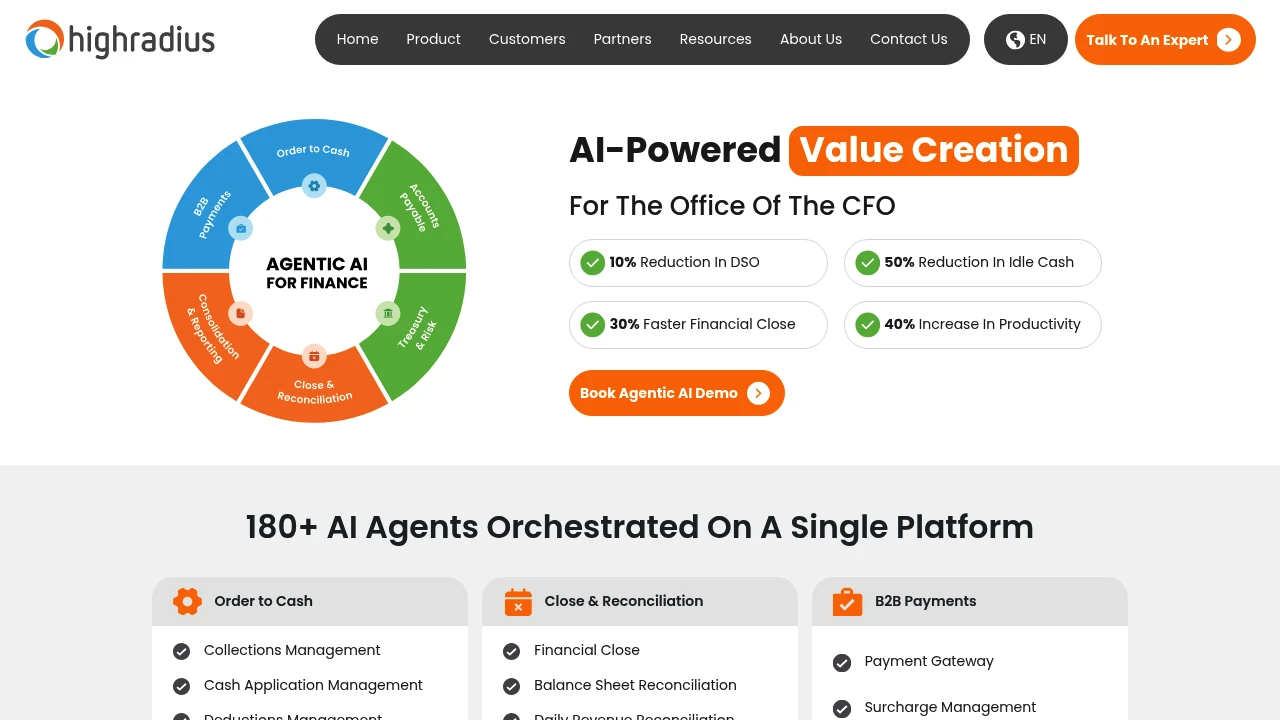

HighRadius provides accounts receivable (AR), credit-to-cash and treasury management automation software for finance organizations, enterprise accounting teams, and shared services centers. It combines prebuilt connectors to ERPs, machine learning for cash prediction and collections, and configurable workflow modules to reduce DSO, improve cash flow visibility, and lower manual effort in receivables operations.

What is highradius

HighRadius is a software suite focused on automating the credit-to-cash lifecycle for mid-market and enterprise finance organizations. The platform centralizes and automates functions across credit management, collections, cash application, deductions management, and treasury to accelerate cash conversion and reduce days sales outstanding (DSO).

HighRadius is delivered primarily as a cloud SaaS platform with modular licensing so organizations can adopt specific capabilities (for example cash application or collections) without replacing core ERP systems. It uses machine learning models trained on receivables patterns to prioritize collection efforts, recommend credit limits, and auto-match incoming payments to open invoices. The vendor emphasizes prebuilt ERP connectors and industry-specific implementations for manufacturing, retail, and distribution.

HighRadius is commonly positioned as a complement to ERPs such as Oracle, SAP, NetSuite, and Microsoft Dynamics: it handles specialized receivables and treasury workflows that are often manual or spreadsheet-driven inside those systems. For global organizations, HighRadius supports multi-currency and multi-entity architectures and often integrates with corporate banking channels for direct payment processing and reconciliation.

HighRadius is suitable for accounts receivable teams, shared services centers, credit managers, and treasury groups who want to reduce manual posting, shorten dispute cycles, and gain predictive visibility into cash flow.

HighRadius features

What does highradius do?

HighRadius automates discrete steps in the credit-to-cash cycle and offers an integrated workflow across those steps. Key functional capabilities include:

- Credit management: score customers using internal and external data, automate credit limit recommendations, and manage credit approvals and renewals.

- Collections management: prioritize customer outreach using risk scoring, schedule tasks and communications, automate dunning and letters, and provide collectors with suggested next actions powered by machine learning.

- Cash application: automatically match lockbox and electronic payments to open invoices using fuzzy matching, remittance parsing, and rules-based matching to reduce unapplied cash.

- Deductions and disputes: centralize claims and dispute workflows, route issues to the right teams, and track resolution timelines to accelerate dispute closings.

- Cash forecasting and treasury: produce short- and medium-term cash forecasts, manage bank connectivity, and support payments and bank reconciliation workflows.

- Order-to-cash analytics and dashboards: prebuilt KPI dashboards for DSO, aging, unapplied cash, promise-to-pay, and collector productivity.

- Machine learning models and recommendations: predictive scoring for payment likelihood, dispute probability, and customer risk to help allocate collector time more effectively.

- Prebuilt ERP connectors and ingestion tools: integrations for SAP, Oracle EBS/Cloud, NetSuite, Microsoft Dynamics, and CSV/flat-file ingestion for legacy systems.

- Security and compliance features: role-based access control, SSO/SAML support, audit logs, and enterprise-grade hosting options.

Beyond these core functions, HighRadius offers implementation accelerators, configurable business rules, and professional services to map corporate processes into the solution.

HighRadius pricing

HighRadius offers custom, enterprise-focused pricing and modular licensing:

- Enterprise: Pricing provided by quote based on modules, number of legal entities, transaction volumes, and integration complexity

- Module-based licensing: Customers license individual modules (Collections, Cash Application, Credit, Deductions, Treasury) with costs scaled to transaction volume and number of users

- SaaS subscription and implementation fees: A combination of one-time implementation services and ongoing subscription fees; larger deployments include professional services and configuration

Typical commercial deployments vary widely with scope: smaller global rollouts often start in the low thousands per month, while enterprise-scale implementations can reach $2,000/month to $25,000+/month depending on volume and depth of automation. Check HighRadius's pricing and deployment options for the most current guidance and to request a tailored quote.

How much is highradius per month

HighRadius typically starts with custom monthly pricing for production deployments; smaller pilot or single-module subscriptions often begin at several thousand dollars per month. Exact monthly pricing depends on which modules you license, transaction volumes (payments, invoices), required SLAs, and the number of ERP entities to be connected.

How much is highradius per year

HighRadius costs are usually quoted on an annual subscription basis and can range from tens of thousands to several hundred thousand dollars per year for enterprise-wide implementations. Annual contracted costs include subscription fees plus any retained support or professional services; longer-term contracts can be structured to include implementation and onboarding fees amortized across the first year.

How much is highradius in general

HighRadius pricing ranges from a small multi-thousand-dollar per month subscription for single-module pilots to enterprise agreements that exceed six figures annually. The effective price depends on the number of legal entities, transaction volume (payment and invoice matches), degree of automation (percentage of cash auto-applied), and integration complexity with ERPs and banks. For an accurate assessment, prospective customers should request a tailored quote and ROI analysis from HighRadius.

Check HighRadius's pricing and solution pages for the latest rates and enterprise engagement details.

What is highradius used for

HighRadius is used primarily to automate accounts receivable, collections, cash application, deduction management, credit underwriting, and treasury forecasting. Finance teams adopt it to reduce manual posting and reconciliation tasks and to consolidate receivables workflows into a single operating model.

Common business use cases include:

- Improving collector productivity by surfacing the highest-impact accounts and automating low-value outreach

- Automating payment matching to lower unapplied cash and manual reconciliation time

- Centralizing dispute resolution to shorten deduction cycles and preserve revenue

- Predicting short-term cash using AR aging, open orders, and historical payment behavior to support treasury planning

HighRadius is often deployed in organizations with decentralized finance teams where standardizing processes across business units and geographies yields rapid operational improvements. It's also used by shared services centers to scale collector capacity and reduce headcount required to manage growing transaction volumes.

Pros and cons of highradius

Pros:

- Centralized automation across the credit-to-cash lifecycle reduces manual effort and improves cash flow visibility

- Machine learning models provide actionable prioritization to collectors and credit teams, improving DSO and collections effectiveness

- Prebuilt connectors simplify integration with major ERPs (SAP, Oracle, NetSuite, Microsoft Dynamics)

- Modular licensing lets organizations adopt specific capabilities without a full-suite deployment immediately

- Enterprise security and compliance features suitable for multinational finance organizations

Cons:

- Enterprise pricing model and implementation scope can be expensive for small companies or very low-volume use cases

- Implementation requires ERP integration and data mapping; projects can take several months for full automation across multiple modules

- Some customers prefer native ERP functionality for simpler workflows; HighRadius adds value primarily in higher-volume or complex receivables environments

- Customization and professional services may be necessary to match legacy processes, adding time and cost

HighRadius free trial

HighRadius does not commonly advertise a public, self-service free trial for enterprise modules because the product deploys against ERP systems and requires data connectivity for meaningful evaluation. Instead, the vendor typically offers:

- Pilot implementations or proof-of-value (POV) engagements that run on a limited scope of modules and data sets

- Sandbox environments for technical testing and user acceptance testing during implementation

- Time-boxed pilots structured with success metrics (e.g., reduction in unapplied cash, percent auto-match) to evaluate ROI

Organizations should contact HighRadius directly to discuss a pilot or proof-of-value. View HighRadius's engagement options on their solutions and services pages to understand typical pilot approaches.

Is highradius free

No, HighRadius is not offered as a free product. It is sold as a commercial SaaS platform with subscription fees and usually a professional services engagement for configuration and integration. For evaluation, the vendor offers pilots and sandbox instances rather than an open free tier.

HighRadius API

HighRadius provides integration capabilities tailored to enterprise ERP and banking systems. Typical API and integration features include:

- RESTful API endpoints for data exchange and process triggers, plus support for batch file ingestion for high-volume transactions

- Prebuilt connectors and adapters for SAP, Oracle, NetSuite, and Microsoft Dynamics that reduce custom mapping work

- Bank connectivity modules to receive bank statements, lockbox files, and payment remittance data directly into the platform

- Webhooks and event notifications to trigger downstream workflows or to inform ERP systems of reconciliation results

- Secure authentication methods including API keys, OAuth, and support for SSO/SAML for user access

HighRadius also exposes extensibility points for custom rules and business logic so organizations can encode company-specific matching logic, collector workflows, and escalation rules. Developers should review the HighRadius integration documentation or request API access during a proof-of-value engagement for exact endpoint definitions and sandbox credentials. For developer and integration resources, see HighRadius's integration and platform documentation.

10 HighRadius alternatives

- Billtrust — Cloud-based AR automation focused on e-invoicing, payments and lockbox automation for B2B suppliers

- YayPay (Quadient) — Collections and AR automation with emphasis on customer experience and self-service portals

- BlackLine — Broader finance close and reconciliation automation with AR-adjacent reconciliation features

- Kyriba — Treasury and payments platform that overlaps with cash forecasting and bank connectivity

- Tipalti — Payables automation and payment orchestration; complementary for payables-heavy organizations

- Sage Intacct — Cloud accounting platform with AR capabilities and partner ecosystem for AR automation

- Oracle NetSuite — ERP with native AR functionality and marketplace partners for advanced receivables automation

- SAP — ERP suite with finance modules; often paired with specialized AR automation vendors for scale

- Zuora — Subscription billing and revenue management platform for companies with recurring revenue models

- Workday Financial Management — Enterprise financials with AR workflows and integrations to specialist automation vendors

Paid alternatives to highradius

- Billtrust: A turnkey AR automation platform focused on invoice presentment, electronic payments, and lockbox processing for B2B billing

- YayPay (Quadient): Offers collections automation, customer portals, and dashboards designed to reduce DSO and improve collector efficiency

- BlackLine: Targets the record-to-report and reconciliation space but includes accounts receivable close controls and automation in broader finance transformation projects

- Kyriba: Strong in treasury and cash forecasting with bank connectivity and payment flows that can overlap with HighRadius treasury features

- Tipalti: Focused on payables, but useful in organizations seeking to automate both receivables and payables with complementary vendors

- Oracle NetSuite: ERP-based AR functionality with a broad partner ecosystem that provides AR automation modules; often selected by fast-growing companies

Open source alternatives to highradius

- Odoo: An open source ERP with accounting and basic receivables modules; good for small-to-mid-market organizations that want to customize workflows

- ERPNext: Open source accounting and ERP with AR, payment matching, and reconciliation features suitable for organizations that can self-host and customize

- Dolibarr: Lightweight open source ERP/CRM with invoicing and payment modules; suitable for smaller companies seeking low-cost automation

- Tryton: Modular open source ERP with accounting components that can be extended to handle AR workflows

Frequently asked questions about HighRadius

What is HighRadius used for?

HighRadius is used for accounts receivable automation and credit-to-cash workflows. Finance teams use it to automate collections, cash application, dispute management, credit decisions, and cash forecasting to reduce DSO and manual ledger work.

Does HighRadius integrate with SAP and Oracle?

Yes, HighRadius provides prebuilt connectors for SAP and Oracle. These connectors simplify data exchange for invoices, payments, and master data and reduce the custom integration work required during implementation.

How much does HighRadius cost per user or per month?

HighRadius typically uses custom pricing rather than per-user list prices; smaller pilots often start at a few thousand dollars per month. Final monthly costs depend on modules selected, transaction volumes, number of entities, and implementation scope.

Can HighRadius automatically match payments to invoices?

Yes, HighRadius includes automated cash application capabilities. It uses rules-based matching, fuzzy string matching, and remittance parsing to auto-apply a high percentage of incoming payments and reduce unapplied cash.

Does HighRadius offer machine learning for collections?

Yes, HighRadius uses machine learning to prioritize collections and predict payment behavior. Models evaluate historical payment patterns, invoice age, and customer risk to recommend which accounts collectors should focus on.

Is there a free version or trial for HighRadius?

No, HighRadius is not available as a free product; pilots and proof-of-value engagements are offered instead. Prospective customers typically run time-boxed pilots to validate ROI before signing an enterprise subscription.

How secure is HighRadius for enterprise financial data?

HighRadius provides enterprise-grade security controls, including role-based access, SSO/SAML support, and audit logging. The solution is designed for multinational deployments and supports common compliance requirements relevant to finance teams.

Can HighRadius help with cash forecasting for treasury teams?

Yes, HighRadius includes cash forecasting and treasury modules for short- to medium-term liquidity planning. The platform aggregates receivables, expected payments, and historical behavior to produce forecast scenarios.

Does HighRadius have an API for integrations?

Yes, HighRadius exposes APIs and prebuilt ERP adapters for integration. APIs typically include REST endpoints, batch file ingestion capabilities, and webhook notifications for event-driven workflows.

How long does it take to implement HighRadius?

Implementation timelines vary but enterprise rollouts commonly take several months. A single-module pilot can be implemented faster (often within a few weeks to a couple of months), while multi-module, multi-entity deployments with complex ERP integrations typically require a longer professional services engagement.

highradius careers

HighRadius recruits finance, engineering, product, sales, and customer success talent for roles that support enterprise software implementations. Career opportunities typically include software engineering positions focused on data processing, machine learning roles for financial forecasting models, implementation consultants for ERP integrations, and product managers for receivables and treasury features. For open roles and hiring programs, review HighRadius's careers pages and job listings on their corporate site.

highradius affiliate

HighRadius offers partnership and reseller programs for system integrators, ERP partners, and channel partners that specialize in finance transformation. Affiliate and partner programs often include co-selling agreements, implementation certification tracks, and access to technical resources to streamline joint deployments. Interested partners should contact HighRadius via their partner program pages to learn about requirements and benefits.

Where to find highradius reviews

Independent user reviews and analyst coverage of HighRadius can be found on software review platforms and industry publications. Search for customer reviews on widely used review sites and read analyst notes that evaluate AR automation vendors. For vendor-authored case studies, ROI examples, and customer references, see HighRadius's customer success and case studies pages.