Upflow

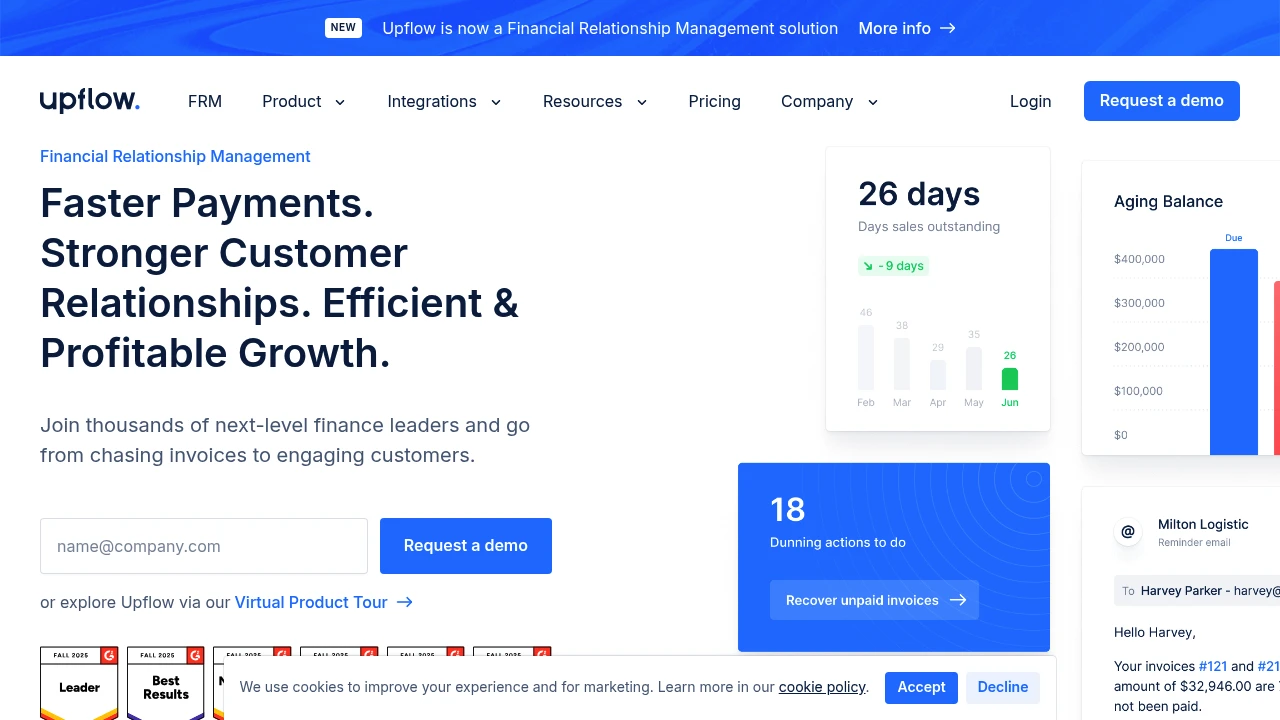

Accounts receivable automation platform for finance teams at SMBs and mid-market companies. Upflow centralizes customer invoices, automates dunning and payment follow-up, links to accounting systems, and provides collections analytics to reduce DSO and manual work for AP/AR teams.

What is upflow

Upflow is an accounts receivable (AR) automation platform that helps finance teams manage invoice collections, customer communication, and receivables reporting. The product centralizes outstanding invoices, automates follow-up sequences (dunning), and provides visibility into customer payment behavior. It is targeted at small and mid-market businesses, SaaS companies, and finance teams that want to reduce days sales outstanding (DSO) and cut the manual effort spent chasing payments.

Upflow connects directly with accounting systems to keep invoice and payment records synchronized, supports multiple payment rails, and surfaces insights and KPIs relevant to collections performance. The platform is typically used by finance managers, controllers, and accounts receivable specialists who handle recurring invoices, subscription billing, and commercial B2B invoicing.

Operationally, Upflow is positioned between the accounting system and the customer: it reads invoices and payments, applies automated follow-up logic, gives AR teams a shared workspace for escalations, and stores audit-ready communication history with customers. This reduces email clutter, standardizes messaging, and enables teams to measure collection efficiency over time.

Upflow features

Upflow includes a set of features focused on invoice visibility, automated communications, payments, and analytics. Those core feature areas are designed to reduce manual collection work while keeping finance teams in control.

Key feature groups include:

- Invoice synchronization: Connects to accounting systems to pull customer invoices and payment status automatically.

- Automated dunning campaigns: Configurable email and SMS sequences that trigger by aging buckets, invoice status, or custom rules.

- Payment links and online payments: Embedded payment options (credit card, ACH, Stripe/PayPal/parts of local rails) to shorten the path to collection.

- Collections workspace: Centralized queue, customer timeline, and task assignment so teams can collaborate on problematic accounts.

- Reporting and analytics: Dashboards for DSO, aging, collection efficiency, and customer-specific payment behavior.

Security, audit, and compliance features are part of the platform as well. Upflow typically supports role-based access control, activity logs for audit trails, and basic encryption in transit and at rest. For enterprise customers it often includes SSO and additional contractual security assurances.

What does upflow do?

Upflow automates the repetitive parts of accounts receivable so teams can focus on exception handling and cash strategy rather than manual chasing. It imports invoices, categorizes them by age, and sends scheduled reminder messages based on rules you define. When customers receive reminders they can click payment links or access invoices via a customer portal, which accelerates collections.

The platform provides a single source of truth for invoice status and all communications, which reduces duplicate outreach and miscommunications between sales, customer success, and finance. Teams can see which reminders were sent, which payment links opened, and which accounts require escalation to phone or collection agencies.

On the reporting side, Upflow aggregates AR metrics across customers, products, or segments so finance leaders can identify delinquent cohorts and measure the monetary impact of process changes. It also supports customer segmentation for different dunning cadences — for example, segmented terms for enterprise customers versus standard small customer follow-up.

Upflow pricing

Upflow offers these pricing plans:

- Free Plan: $0/month with basic invoice dashboard, limited users, and manual reminders

- Starter: $99/month with automated dunning for up to 500 invoices, email support, and basic payment links

- Professional: $349/month with expanded automation, priority support, integrations with multiple accounting systems, and advanced reporting

- Enterprise: Custom pricing with SSO, dedicated onboarding, service-level agreements, and custom integrations

For teams that expect volume discounts or need multi-entity configurations, Upflow typically provides custom annual contracts. Check Upflow's current pricing for the latest rates and enterprise options.

How much is upflow per month

Upflow starts at $99/month for the Starter plan. That monthly rate commonly covers automated collections for a capped number of invoices and basic payment link functionality. Mid-tier plans are typically priced at $349/month for the Professional tier, while Enterprise pricing is quoted based on usage and requirements.

Monthly billing is often available but annual billing discounts are commonly offered. Teams with fluctuating invoice volume should review billing policies carefully, because some vendors apply overage fees for invoices or contacts beyond a plan's cap.

How much is upflow per year

Upflow costs approximately $1,188/year for the Starter plan if billed annually at the equivalent of $99/month with no discount, and roughly $4,188/year for the Professional plan at $349/month. Enterprise customers receive custom annual pricing and may get onboarding and support included in the first-year costs.

If Upflow offers a multi-year commitment or a promotional discount, the annual rate can be lower; always verify current offers on their official rate page. Check Upflow's current pricing for the latest billing models and enterprise terms.

How much is upflow in general

Upflow pricing ranges from $0 (free) to $1,200+/month. Small teams with light invoice volume can often operate on the Free or Starter tiers, while growing businesses with more invoices and multi-system integrations will land in the Professional or Enterprise tiers. Expect custom quotes for high-volume or multi-entity deployments.

Price drivers include number of invoices processed, number of customers (contacts) in the system, payment rail usage (payment provider fees are separate), and level of support and compliance required.

What is upflow used for

Upflow is used primarily for centralizing accounts receivable operations and automating the collection lifecycle. Finance teams use it to reduce DSO, lower delinquency rates, and improve cash-flow predictability by making follow-up systematic rather than ad hoc. By automating standard reminders and providing payment convenience, Upflow shortens the time between invoice issuance and payment.

The tool also serves as a collaboration hub for cross-functional teams that touch billing: customer success can see outstanding balances relevant to renewals; sales can be alerted before contract changes; and operations can reconcile unapplied payments with invoices. This shared visibility eliminates duplicate outreach and speeds dispute resolution.

Finally, Upflow is used for reporting and forecasting. The platform aggregates aging schedules, calculates DSO trends, and surfaces high-risk customers so companies can prioritize collection efforts or offer tailored payment plans. These insights support both short-term cash management and longer-term credit policies.

Pros and cons of upflow

Pros:

- Automated dunning reduces manual email follow-ups and standardizes communication.

- Integration with accounting systems preserves the canonical invoice record and reduces reconciliation work.

- Embedded payment links and customer portal shorten payment cycles and improve payer experience.

Cons:

- Cost can grow with invoice volume and the need for custom integrations; Enterprise features typically require custom contracts.

- Some customers may prefer phone-first collections for certain segments; automation requires careful cadence tuning to avoid customer friction.

- For complex contracts or heavy dispute volumes, more specialized collections workflows or CRM integrations may be necessary.

Practical considerations: Upflow is strongest where invoices are relatively standardized and customers respond well to digital reminders. If your business relies heavily on manual negotiation for each invoice, Upflow can still help but requires more manual intervention and custom workflows.

Upflow free trial

Upflow commonly offers a free trial or a limited Free Plan tier that allows teams to evaluate core features such as invoice imports, basic reminders, and the collections dashboard. The trial is intended to show how automated reminders work and how payment links reduce DSO.

During the trial period, teams should test connection stability to their accounting system, validate how invoices are synced, and run a sample dunning campaign against non-critical customers to observe response rates. Trials also serve to test payment integrations and the customer portal experience.

For longer evaluations, Upflow provides guided onboarding in paid plans so finance teams can migrate historical invoice data, tune the dunning cadence, and configure custom fields or tags. Check Upflow's onboarding and trial information for current offers and trial durations.

Is upflow free

Yes, Upflow offers a Free Plan with basic invoice dashboard functionality and limited automated reminders intended for very small teams or evaluation purposes. The Free Plan is useful for getting a feel for the platform, but it typically lacks advanced automation, priority support, and volume allowances present in paid tiers.

Upgrading to Starter or Professional unlocks automated dunning at scale, more users, and deeper integrations. Confirm the exact limits on the Free Plan on the official pricing page before relying on it for production use.

Upflow API

Upflow exposes an API that allows syncing invoices, payments, customers, and webhook events for status changes. The API is commonly RESTful, using JSON for payloads, and supports endpoints to create or update customer records, mark invoices as paid, and fetch aging or metric data programmatically.

Common API use cases include custom integrations with a proprietary billing system, pushing collection events into a CRM, or automating reconciliation scripts that run overnight. Webhooks are used to notify external systems when an invoice status changes, a payment is received, or a dunning email bounces.

Developers should expect authentication via API keys or bearer tokens, rate limits appropriate to plan level, and sandbox or test modes for initial integration. For details on endpoints, authentication patterns, and example payloads, consult Upflow's developer documentation and API reference. View Upflow's integration catalog and API details for current developer resources.

10 Upflow alternatives

- Chaser — Accounts receivable automation focused on email chase sequences and payment links.

- Stampli — Invoice management and AP/AR collaboration targeted at streamlining invoice approvals and exceptions.

- YayPay — Collections automation that includes credit management and payment plans.

- Bill.com — End-to-end AP/AR automation with payments and accounting integrations for mid-market firms.

- HighRadius — Enterprise-grade receivables automation and cash application technology.

- QuickBooks — Accounting platform with basic AR features and payment collection for SMBs.

- Xero — Cloud accounting with invoicing and payment capabilities for small businesses.

- Sage Intacct — ERP and accounting platform with robust AR modules for finance teams.

- Zuora — Subscription billing and collections for recurring revenue businesses.

- Odoo — Modular ERP with invoicing and collections in an open-source core.

Paid alternatives to Upflow

-

Chaser: Chaser focuses on automated email chasing and integrates with QuickBooks and Xero. It's well-suited for teams that want lightweight automation without a heavy ERP integration.

-

Stampli: Stampli targets invoices and approval workflows, often used by businesses that need hands-on exception handling in both AP and AR contexts.

-

YayPay: YayPay provides collections automation and credit intelligence, with features for forecasting cash flow and setting payment terms by customer segment.

-

Bill.com: Bill.com offers payments and receivables alongside vendor and customer payment rails; it appeals to companies wanting a single vendor for payables and receivables.

-

HighRadius: HighRadius is oriented toward enterprise customers needing advanced cash application, automated allocation, and large-scale reconciliation.

Open source alternatives to Upflow

-

Odoo: Odoo is an open-source ERP that includes invoicing and payment follow-up modules. It requires more setup but is flexible for teams that want source-level customization.

-

ERPNext: ERPNext provides invoicing and collections features within an open-source accounting suite; it's suitable for small teams comfortable managing their own hosting or using managed providers.

-

InvoicePlane: InvoicePlane is a standalone open-source invoicing application that supports customer invoicing and basic reminders; it’s lightweight and self-hosted.

-

Dolibarr: Dolibarr is an open-source ERP/CRM that includes invoicing and AR features and is appropriate for organizations willing to self-host and extend functionality.

Frequently asked questions about Upflow

What is Upflow used for?

Upflow is used for accounts receivable automation and collections management. It centralizes invoices from your accounting system, automates reminder sequences, provides payment links, and delivers analytics to reduce DSO and manual follow-up work for finance teams.

Does Upflow integrate with QuickBooks and Xero?

Yes, Upflow integrates with major accounting systems like QuickBooks and Xero. These integrations let Upflow import invoice and payment data automatically so AR teams work from an up-to-date source of truth; integration coverage may vary by plan and account type.

How much does Upflow cost per user per month?

Upflow starts at $99/month for the Starter plan and does not typically charge per-seat fees for basic tiers; pricing is usually driven by invoice volume and feature set rather than strict per-user charges. Enterprise pricing is custom.

Is there a free version of Upflow?

Yes, Upflow offers a Free Plan that includes a basic invoice dashboard and limited reminders to help small teams evaluate the platform before upgrading to a paid plan.

Can Upflow send payment links to customers?

Yes, Upflow supports embedded payment links and a customer portal. Customers can receive secure links in reminder emails or access a portal where they can pay outstanding invoices using supported payment methods.

Does Upflow provide an API for developers?

Yes, Upflow offers a RESTful API and webhooks for integrations. The API allows creation and updating of customers and invoices, retrieving status data, and receiving event notifications for invoice and payment changes.

Can Upflow reduce my DSO?

Yes, Upflow is designed to reduce DSO by automating reminders and offering simpler payment paths. Typical improvements depend on cadence, customer base, and payment options, but many customers report measurable DSO reductions after implementing automated dunning.

Is Upflow secure for financial data?

Yes, Upflow implements standard security controls for financial platforms. Expect TLS for data in transit, encryption at rest, role-based access controls, and activity logs; enterprise customers can usually arrange additional assurances like SSO or contractual security addenda.

Can Upflow handle multiple currencies and international payments?

Yes, Upflow supports multi-currency invoicing and common international payment rails. Payment availability depends on the configured payment provider and the customer's country, so confirm supported rails during onboarding.

How long does it take to implement Upflow?

Implementation timelines vary but typically range from a few days to several weeks. A simple connection to Xero or QuickBooks and a few test dunning sequences can be completed quickly, while complex ERP integrations, custom mappings, or multi-entity setups require longer onboarding.

### upflow careers

Upflow hires across product, engineering, customer success, and operations roles to support product development and customer onboarding. Common roles for the company include software engineers focusing on APIs and integrations, product managers for AR workflows, and customer success managers who lead onboarding and training. Candidates typically should demonstrate experience with B2B SaaS, finance-related products, or payments infrastructure.

Companies hiring for Upflow often look for proficiency in cloud-native stacks, API design, and experience integrating with accounting platforms like QuickBooks, Xero, or NetSuite. For the latest openings and recruitment practices, consult Upflow’s careers page or professional job boards.

### upflow affiliate

Upflow may offer partner or reseller programs that provide referral fees or revenue shares for agencies and consultants that bring customers to the platform. These affiliate or partner programs usually include co-marketing support, technical onboarding for partners, and access to partner-specific resources.

If you are an accounting firm, implementation partner, or payments integrator, inquire directly with Upflow’s partnerships team to learn about commission structures, minimum performance thresholds, and partner tiers.

### Where to find upflow reviews

You can find user reviews of Upflow on SaaS review platforms and community forums that cover finance software. Look for detailed reviews on sites specializing in accounting and finance technology as well as on broader marketplaces. When assessing reviews, prioritize feedback from companies with similar invoice volume and business models.

For vetted case studies and customer references, consult Upflow’s website where they typically publish customer stories illustrating DSO improvements and automation outcomes. Also compare independent reviews on accounting software directories to get a balanced view of strengths and limitations.