Taxomate

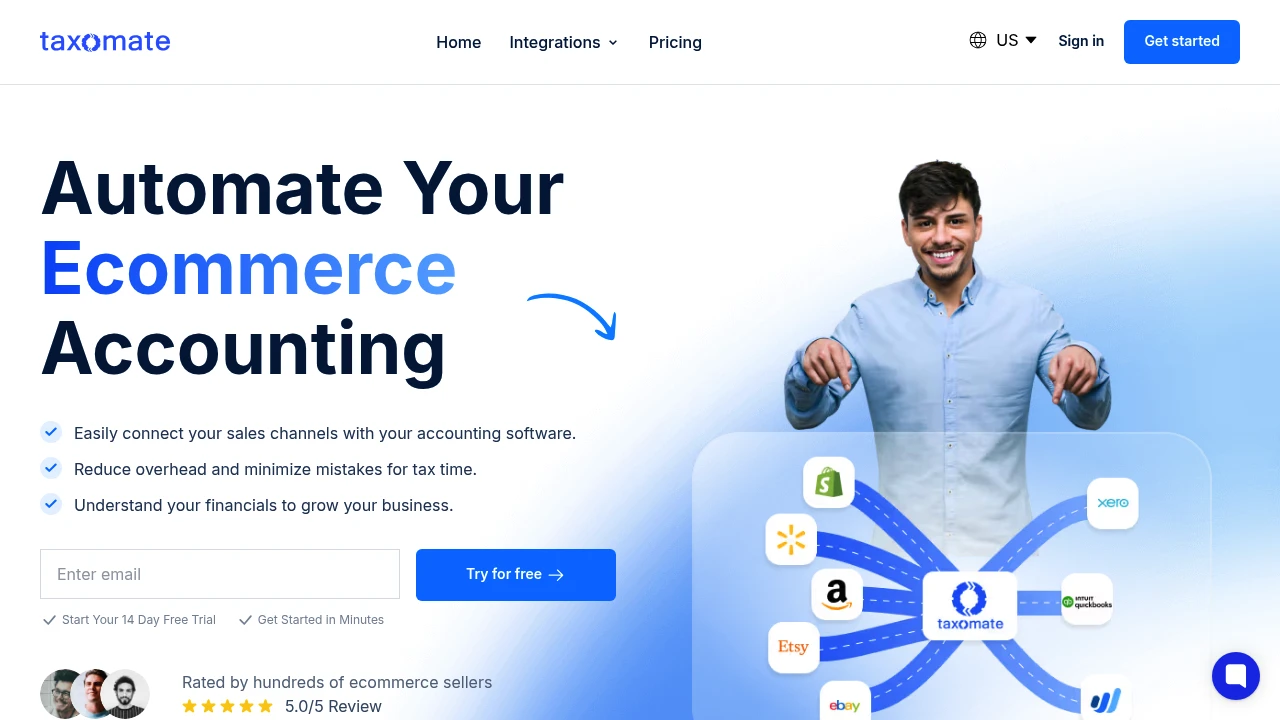

Automates marketplace transaction extraction, allocation, and posting to accounting systems (QuickBooks Online, Xero). Designed for Amazon, Shopify and multi-channel sellers, and the accountants who support them.

What is taxomate

Taxomate is a cloud service that extracts sales, fees, refunds, and settlement data from marketplace platforms and converts those marketplace events into accounting-ready journal entries and invoices. It acts as a bridge between marketplaces (Amazon, Shopify, eBay, etc.) and accounting systems like QuickBooks Online and Xero so sellers and bookkeepers can reconcile settlements automatically instead of manually mapping CSVs and transforming data.

The service focuses on accurate allocation of marketplace components — product sales, taxes, shipping, marketplace fees, promotions, and reimbursements — and groups those elements into the bookkeeping records most accounting packages expect. Taxomate also includes automation rules, mapping templates, and scheduled posting so users can process large volumes of transactions consistently.

Primary users are e-commerce sellers with daily or weekly settlements, accounting firms that manage multiple seller clients, and internal finance teams that want to reduce manual reconciliation work. Typical deployment is SaaS: connect a marketplace, configure mappings to QuickBooks Online or Xero, and let scheduled imports create draft or posted entries for review.

Taxomate’s workflow-centric approach reduces common reconciliation errors — misapplied fees, missing refunds, and tax misallocations — by preserving marketplace-level detail and offering customizable mapping rules to align marketplace data with existing chart of accounts and tracking classes.

Taxomate features

What does taxomate do?

Taxomate imports settlement and transaction feeds from marketplaces, normalizes each transaction, and generates accounting entries you can post automatically or review before posting. It breaks settlements into component lines (product, shipping, tax, fees, promotions) and groups them per accounting period or settlement ID to match how accounting systems expect the data.

Key features include scheduled ingestion of marketplace settlements, flexible mapping of marketplace columns to accounting accounts and tax codes, automatic matching of payouts to bank deposits, and configurable rules to handle refunds, reimbursements, and inventory adjustments. It supports both single-entity sellers and multi-entity setups where different marketplaces or regions post to separate books.

Taxomate provides connectors to QuickBooks Online and Xero with the ability to create Sales Receipts, Invoices, Journal Entries, or Bank Transactions depending on the bookkeeping workflow. It supports posting to classes, locations, tracking categories, and customer/job fields so entries flow into existing accounting reports without extra manual adjustments.

Additional features include CSV import/export for marketplaces or third-party reports, historical data import, reporting dashboards for reconciliation status, user and role management for accounting teams, and an activity audit log to track what data was changed or posted.

Taxomate also includes built-in templates for common marketplace platforms so setup time is reduced. These templates capture common fee structures and settlement formats but remain editable to adapt to promo types, tax rules, or special adjustments.

Taxomate pricing

Taxomate offers these pricing plans:

- Free Plan: $0/month for a single user with limited marketplace connections and basic historical import (suitable for evaluation or very small sellers)

- Starter: $15/month billed monthly or $12/month when billed annually (per storefront or per connection limits apply)

- Professional: $39/month billed monthly or $29/month when billed annually (higher transaction limits, multiple storefronts, automated posting)

- Enterprise: $99/month billed monthly or custom annual pricing for high-volume accounts and dedicated onboarding

Check Taxomate's current pricing plans for the latest rates and enterprise options.

Taxomate pricing

Taxomate price structure typically separates plan tiers by monthly import volume, number of connected storefronts, and available automation features. The Free Plan gives a small number of transactions per month and limited posting options so new users can evaluate mappings. The Starter plan unlocks scheduled imports and basic posting to one accounting file, while Professional increases volume, adds multi-storefront support and advanced mapping rules. Enterprise includes higher throughput, priority support, and options for white-glove onboarding.

Many teams choose annual billing to obtain a discounted per-month equivalent; Taxomate generally offers 10–25% discount for yearly subscriptions depending on plan. For large accounting firms or merchants with many marketplaces, Enterprise subscriptions can include account management and custom integration work.

Payment is usually handled via credit card on a monthly or annual cadence; invoices for annual Enterprise contracts may be available with ACH or bank transfer depending on the contract. Add-ons such as extra storefront connections, historical imports beyond the included quota, or custom integration work are commonly offered at incremental fees.

For current and exact pricing details and limitations by transaction volume, review the authoritative pricing information directly at Taxomate's pricing plans.

How much is taxomate per month

Taxomate starts at $15/month for the Starter plan when billed monthly. This entry-level tier covers basic automation and a limited number of marketplace connections and is intended for low-volume sellers or single-store operations.

How much is taxomate per year

Taxomate costs $144/year for the Starter plan when billed annually at the equivalent of $12/month (annual discounts vary by plan). The Professional and Enterprise plans offer larger annual savings relative to monthly pricing and are priced higher to reflect expanded transaction allowances and features.

How much is taxomate in general

Taxomate pricing ranges from $0 (free) to around $99+/month depending on plan, transaction volume, and add-ons. Small sellers typically fall in the $15–$39/month range, while accounting firms and high-volume sellers often select the $99+/month Enterprise tier or negotiate custom pricing.

What is taxomate used for

Taxomate is used to convert complex marketplace settlements into bookkeeping-ready transactions to reduce manual reconciliation and posting work. Sellers use it to ensure each marketplace event — sale, fee, tax, shipping, promotion, refund — is captured, categorized, and posted consistently to their accounting ledger.

Accountants and bookkeepers use Taxomate to standardize how client marketplaces are processed so monthly books are consistent, audit trails are maintained, and bank deposits can be reconciled quickly. The ability to preview or automatically post entries saves hours of manual CSV manipulation and reduces human error in account mapping.

Taxomate is also useful when sellers operate across multiple marketplaces or currencies: it groups and aligns settlement batches, converts amounts to accounting currency based on settlement details or bank deposits, and attaches reference IDs so each entry can be traced back to the original marketplace settlement.

Finance teams use Taxomate to generate consistent revenue reports by channel, track marketplace fee trends, and identify refunds or chargebacks that affect cash flow. The product also helps separate tax liabilities reported by marketplaces from net proceeds, which is important for sales tax and VAT reporting.

Pros and cons of taxomate

Pros:

- Automates high-volume settlement processing, reducing routine bookkeeping time and repetitive CSV work.

- Preserves marketplace detail and maps fees, taxes, shipping, and promotions to specific accounts and tracking fields.

- Integrates directly with QuickBooks Online and Xero, creating entries that align with common bookkeeping workflows.

- Scheduled imports and posting reduce lag between settlement and ledger posting, improving cash flow visibility.

- Templates and mapping rules let accounting teams standardize processes across multiple seller clients.

Cons:

- Plan limits by transaction volume or storefront connections may require upgrading for growing businesses; higher tiers increase costs.

- Users with highly customized accounting setups may need time to configure mappings and reconcile edge cases like VAT/gst adjustments or complex multi-currency postings.

- Enterprise-level customizations or very large historical imports can carry additional implementation costs.

Operational considerations include ensuring accurate chart of accounts alignment before enabling automatic posting, setting appropriate review workflows for draft entries, and validating reconciliation between posted entries and bank deposits released by marketplaces.

Taxomate free trial

Taxomate commonly offers a trial or a Free Plan that allows new users to connect a single storefront and run a limited number of imports so they can validate mappings and posting behavior. The Free Plan is useful to confirm the platform can parse settlements correctly and generate the expected journal entries in the selected accounting system.

During the trial period, users should test multiple settlement scenarios: standard sales, refunds, reimbursements, promotions, and fee-only adjustments. This helps identify mapping or categorization issues before enabling automated posting to a production accounting file.

Onboarding resources typically include setup guides, templates, and support documentation. For accounting firms, Taxomate often offers resources to apply consistent templates across multiple client accounts during the trial to scale faster after purchase.

Is taxomate free

Yes, Taxomate offers a Free Plan suitable for evaluation and very low-volume sellers. The Free Plan usually has limits on the number of transactions and connected storefronts but allows testing of core features and connection workflows without an immediate subscription.

Taxomate API

Taxomate provides programmatic interfaces and webhook capabilities to support automation and integration beyond its built-in connectors. The API typically allows retrieving processed transaction data, pushing custom CSVs for parsing, and managing connection or mapping configurations programmatically for advanced workflows.

Common use cases for the API include building private integrations to ERP systems, exporting normalized transaction data for custom reporting, or triggering downstream processes (e.g., inventory adjustments, tax reporting pipelines) when a settlement is processed. Webhooks enable near real-time notifications when new settlements are ingested or when entries have been posted to an accounting system.

Authentication for the API usually employs API keys or OAuth flows depending on the endpoint and the level of access required. Rate limits and data export limits are typical considerations; enterprise customers can often negotiate higher quotas and direct support for large-scale data needs.

For developers implementing integrations, Taxomate’s documentation describes endpoint schemas, sample payloads for different marketplace events, and recommended reconciliation patterns to match bank deposits to posted accounting entries. Review the official developer resources at Taxomate's integrations and API documentation for detailed examples and authentication methods.

10 Taxomate alternatives

Below are a mix of paid and open-source tools that sellers and accountants evaluate when selecting marketplace-to-accounting automation.

Paid alternatives to taxomate

- A2X — Specialized in automating Amazon, Shopify, Walmart, and other marketplace settlements into accounting systems with strong multi-currency and tax handling. Often compared for its tight reconciliation and payout-matching workflows.

- Bookkeep — Focuses on bookkeeping automation for e-commerce with rule-based mappings and integrations into QuickBooks and Xero; includes managed bookkeeping as an add-on service.

- SellersFunding (accounting add-ons) — Offers marketplace data processing as part of broader merchant services and accounting toolsets for sellers needing capital and analytics with bookkeeping integrations.

- Cha-ching/ChannelGrabber (accounting integrations) — Provides multi-channel order and settlement management with exports and integrations to account systems for sellers with high order volumes.

- Sync with custom middleware (professional services) — Many larger sellers opt to build a custom ETL and reconciliation layer or hire a service provider to map marketplace data directly to their ERP, which is effectively a paid alternative to an off-the-shelf SaaS.

Open source alternatives to taxomate

- Odoo — Open source ERP with connectors and modules that can be configured to import marketplace reports and post accounting entries. Requires setup and potentially custom development.

- ERPNext — Community-driven ERP that supports accounting workflows; with scripting and import tools, it can be adapted to process marketplace settlements.

- GnuCash — Desktop accounting software that can import CSVs and be used as a lower-cost bookkeeping option, though it lacks direct marketplace connectors and requires manual or scripted imports.

- Ledger CLI — Plain-text accounting system for technically proficient users; requires custom parsing and scripting to convert marketplace settlements into ledger transactions.

- Apache OFBiz — A larger open-source commerce and ERP platform that can be extended to handle marketplace transaction feeds and post to accounting ledgers with development effort.

When evaluating alternatives, trade-offs include development/setup cost for open-source options, managed automation and reconciliation features for paid SaaS, and availability of accountant-friendly reporting and integrations.

Frequently asked questions about Taxomate

What is Taxomate used for?

Taxomate is used for converting marketplace settlements into accounting-ready transactions. Sellers and accountants use it to automate the mapping of sales, fees, taxes, shipping, and refunds into QuickBooks Online or Xero so bookkeeping is consistent and reconcilable. It reduces manual CSV work and helps match payouts to bank deposits.

Does Taxomate integrate with QuickBooks Online?

Yes, Taxomate integrates with QuickBooks Online. The integration allows Taxomate to create Sales Receipts, Journal Entries, Invoices, or Bank Transactions in QuickBooks Online depending on your workflow and posting preferences. It supports mapping to accounts, classes, and locations used in QBO.

Can Taxomate post transactions to Xero?

Yes, Taxomate supports posting to Xero. The connector creates properly mapped journal entries or invoices in Xero and supports tracking categories, tax rates, and multi-currency transactions where applicable. It helps reconcile Xero bank transactions with marketplace payouts.

How much does Taxomate cost per user or per month?

Taxomate starts at $15/month for the Starter plan when billed monthly and offers higher tiers for more volume and storefronts. Actual costs depend on transaction volume, number of storefronts, and whether you choose monthly or discounted annual billing.

Does Taxomate offer a free trial?

Yes, Taxomate provides a Free Plan or trial tier. This allows new users to connect a storefront and try core import and mapping features with a limited number of transactions to validate parsing and posting behavior before committing to a paid plan.

Does Taxomate handle multi-currency settlements?

Yes, Taxomate handles multi-currency settlements. It can capture settlement currency, convert amounts for accounting entries based on your accounting system’s requirements, and include settlement-level FX details or reference numbers to assist with bank reconciliation.

Is Taxomate suitable for accounting firms?

Yes, Taxomate is suitable for accounting firms that manage multiple seller clients. It supports multi-client workflows, template-based mappings to standardize processing, and role-based access so firms can manage several storefronts while maintaining client separation and audit trails.

Can Taxomate match marketplace payouts to bank deposits?

Yes, Taxomate supports payout-to-bank deposit matching. The platform groups marketplace events into settlement batches and provides tools to reconcile those batches with the actual deposits your bank receives, reducing the time needed to reconcile cash receipts.

Does Taxomate support refunds and reimbursements?

Yes, Taxomate supports refunds, reimbursements, and adjustments. It parses refunds and reimbursement lines from settlement reports and applies mapping rules so refunds reduce revenue and reimbursements map to the appropriate expense or income accounts rather than being lost in net settlement amounts.

What marketplaces does Taxomate support?

Taxomate supports major marketplaces such as Amazon and Shopify and common channels like eBay and Etsy. It includes templates and parsers for common settlement formats and allows CSV imports for less-common marketplaces or custom reports.

taxomate careers

Taxomate hires across product, engineering, customer success, and operations roles to support marketplace accounting automation and integrations. Careers typically emphasize experience with SaaS, integrations, and payments or marketplace platforms. For current openings and hiring practices, check the company’s careers page or LinkedIn presence for the latest opportunities.

taxomate affiliate

Taxomate may run partner or referral programs for accountants, consultants, and agencies that refer clients. Affiliate terms often include referral credits or partner-tier benefits for volume referrals and may include co-marketing resources. Prospective partners should contact Taxomate’s partnerships team via their website to request program details and eligibility.

Where to find taxomate reviews

You can find user reviews and comparative feedback on independent review sites and marketplaces that cover accounting and e-commerce tools. For vetted reviews and customer case studies, check Taxomate’s own customer stories and the Reviews & Testimonials sections; for broader community feedback, consult accounting software review platforms and seller forums where users discuss reconciliation tools and integrations.