Chaserhq

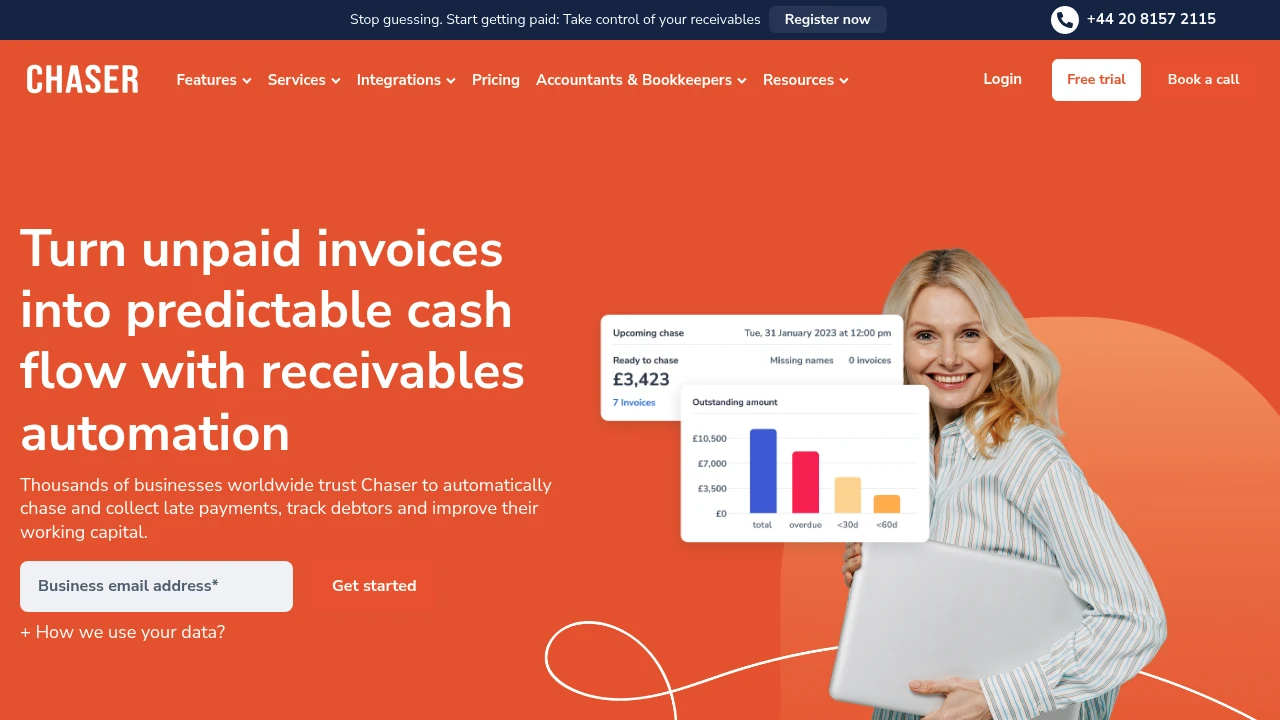

Accounts-receivable automation platform for finance teams that automates invoice chasing, customer reminders, payment reconciliation, and collections workflows. Designed for accountants, finance teams and small-to-medium businesses using cloud accounting systems.

What is chaserhq

Chaserhq is an accounts-receivable (AR) automation platform that automates invoice follow-up and collections communications. The product connects to cloud accounting systems, schedules automated reminder sequences, and centralizes debtor information so finance teams spend less time on manual chasing. Chaserhq is commonly used by accountants, in-house finance teams, and bookkeeping practices to reduce days sales outstanding (DSO) and improve cash flow predictability.

The platform focuses on rule-based communications: email reminders, SMS/push options where available, and escalation to more formal chase letters or internal tasks. Chaserhq maintains a history of communications per customer, logs changes to invoice status, and offers reporting on outstanding balances, aging bands, and chasing effectiveness. The product also provides configurable templates and cadence sequences so teams can enforce consistent collection policies across all clients or subsidiaries.

Chaserhq is built to integrate with major accounting systems and payment providers, enabling automated reconciliation of payments and one-click payment links in reminders. It also exposes an API and webhooks so finance systems can automate case creation, status updates, and reporting. For up-to-date commercial details, see Chaserhq's pricing plans at https://www.chaserhq.com/pricing.

Chaserhq features

What does chaserhq do?

Chaserhq automates the process of following up on unpaid invoices. It imports invoices from connected accounting packages, segments customers by aging, and triggers multi-step reminder sequences based on configurable rules. The platform centralizes communications in a timeline per debtor and can attach invoice PDFs and payment links to reminders.

The system includes configurable templates for tone and frequency, automated escalation rules (for example, escalate to phone-call tasks after N days overdue), and scheduled batch runs so teams can leave routine chasing to the system. It tracks metrics such as average days late, promise-to-pay rates, and recovery percentages to help teams measure the effectiveness of their collection strategies.

Chaserhq also offers reporting and dashboards that highlight high-risk customers, outstanding balances by period, and the performance of chase sequences. Additional features typically include tagging and segmentation, downloadable communication logs, permissioned user roles for finance teams and external accountants, and secure links for customers to view and pay invoices online.

Chaserhq pricing

Chaserhq offers these pricing plans:

- Free Plan: 14‑day free trial with full feature access for evaluation

- Starter: $39/month (billed monthly) or $390/year (billed annually) for small teams; includes core automation and up to a modest number of connected customers

- Professional: $99/month (billed monthly) or $990/year (billed annually) for growing teams; adds more connectors, advanced templates, and reporting

- Enterprise: Custom pricing for high-volume users and multi-entity deployments with SLA, dedicated onboarding, and advanced security

Pricing above reflects typical plan structures used by AR automation vendors; exact tiers, usage limits, and discounts may vary. Check Chaserhq's current pricing plans at https://www.chaserhq.com/pricing for the latest rates and enterprise options.

How much is chaserhq per month

Chaserhq starts at $39/month for the Starter plan when billed monthly. That entry-level plan commonly covers small teams that need automated reminders, basic integrations and limited user seats. Monthly billing is useful for short-term projects or smaller practices that prefer a subscription without long-term commitment.

Professional tiers and Enterprise options are priced higher to reflect increased volume, additional connectors, multi-entity support, and service-level agreements. Monthly overage or per-customer charges may apply once you exceed included limits, so review the fine print on included users, debtor counts, and number of automation runs.

For precise per-month costs that match your customer count and integration needs, review Chaserhq's product pricing page at https://www.chaserhq.com/pricing.

How much is chaserhq per year

Chaserhq costs $390/year for the Starter plan when billed annually (equivalent to $39/month with a 12‑month commitment). Annual billing typically reduces the effective monthly cost and can include priority onboarding credits or reduced per-user fees for larger seats.

Higher tiers such as the Professional plan generally have annual rates in the region of $990/year or more depending on included features and seat counts. Enterprise contracts are negotiated annually with volume discounts and additional professional services added into the yearly agreement.

If you want the exact annual total for your organization, consult Chaserhq's published enterprise options and annual discounts on their pricing section at https://www.chaserhq.com/pricing.

How much is chaserhq in general

Chaserhq pricing ranges from trial/free evaluation to $200+/month for mid-market professional plans and custom enterprise pricing for high-volume users. Small businesses typically budget for a Starter-tier monthly fee plus any optional professional services or payment processing fees, while mid-size companies plan on Professional-tier or Enterprise contracts that include onboarding and integration work.

Budget items to consider when evaluating total cost: Implementation costs: time to connect and map invoice fields; Onboarding services: optional fee for dedicated setup; Payment processing fees: third‑party payment provider charges; Volume surcharges: if the number of debtors or automation runs exceeds plan limits. Estimating these elements helps compare total cost to internal staff time spent chasing invoices.

For an accurate cost estimate specific to transaction volume and integrations, view Chaserhq's pricing details and contact their sales team through the pricing pages at https://www.chaserhq.com/pricing.

What is chaserhq used for

Chaserhq is used primarily to reduce manual work in accounts receivable and improve cash collection outcomes. Teams use it to schedule and send automated payment reminders, escalate unpaid invoices to collection workflows, and track all debtor interactions in a single location. The tool supports a range of collection strategies from polite reminders to formal late-notice sequences.

Use cases include: consolidating collections for multiple client companies in an accounting practice, standardizing reminder cadence across a corporate finance function, and integrating payment links directly into reminders to speed up receipting. It’s also useful for producing management reports on DSO trends, overdue balances by customer segment, and recovery performance for accounting oversight.

Because Chaserhq connects to accounting systems, it reduces reconciliation work by matching received payments to invoices and adjusting the chase status automatically. This makes it suitable for teams that need accurate, real-time visibility into receivables without manual exports and spreadsheets.

Pros and cons of chaserhq

Pros: Chaserhq reduces repetitive manual chasing through automated sequences, integrates with common accounting systems to avoid duplicate data entry, and stores a full audit trail of communications. It helps reduce DSO and provides measurable metrics for finance managers to tune collection policies. The platform typically includes templates, escalation rules, and payment links to increase conversion from reminder to payment.

Cons: Automated messaging can require careful configuration to avoid customer friction—tone, cadence, and escalation triggers must be tuned for different customer segments. Small businesses with very low invoice volumes may find subscription costs higher than sporadic manual chasing. Additionally, advanced features like multi-entity administration, SSO, or custom SLAs are often limited to Enterprise plans, which require negotiation and higher commitment.

Operational considerations: implementers should plan time for mapping invoice fields, creating appropriate templates, and setting exception rules for disputed invoices. Finance teams should also define internal processes for handing off escalations and reconciling payments that arrive outside normal channels.

Chaserhq free trial

Chaserhq typically provides a 14‑day free trial that enables new customers to connect an accounting system, import a sample of invoices, and run chase sequences on a limited set of debtors. The free trial is designed to evaluate sequence effectiveness, test integration behaviour and confirm templates without immediate financial commitment.

During the trial, you can validate common workflows—such as importing invoices from Xero or QuickBooks, sending reminders with payment links, and confirming that payment reconciliation updates invoice status automatically. The trial environment often includes access to reporting to measure expected reductions in overdue days.

After the trial ends, the account usually converts to a paid plan; some vendors also permit limited free tiers for very small users or accounting partners who manage a few clients. Check the trial terms on Chaserhq's site at https://www.chaserhq.com/pricing for specific trial duration and limitations.

Is chaserhq free

No, Chaserhq is not permanently free; it offers a free trial period for evaluation. The core product is subscription‑based, with Starter, Professional and Enterprise plans depending on team size and feature needs. Some vendors in the AR automation space offer limited-feature free tiers, but full automation and multi-user features typically require a paid plan.

If you only need periodic reminders for a handful of customers, a free trial can validate the product without upfront cost, but ongoing use generally requires a paid subscription. Confirm available free-tier options and trial conditions on Chaserhq's pricing and signup pages at https://www.chaserhq.com/pricing.

Chaserhq API

Chaserhq exposes a RESTful API and webhook endpoints to allow automated workflows and integrations beyond pre-built connectors. Typical API capabilities include retrieving customer and invoice records, triggering reminder sequences, updating invoice chase statuses, and retrieving communication logs for reconciliation. Webhooks notify external systems of status changes such as payment received, reminder sent, or debtor notes added.

Developers use the API to integrate Chaserhq into ERP systems, custom reporting pipelines, or CRM workflows. Example integrations include creating a support ticket when an invoice is disputed, automatically suspending reminders when a customer enters a payment plan, or exporting aging data nightly to a business intelligence stack. API authentication is commonly token-based (API key or OAuth) and rate limits are applied to protect multi-tenant infrastructure.

For production use, check Chaserhq's API documentation for exact endpoints, authentication schemes, and webhook topic lists. The API documentation provides sample requests for common tasks like starting a chase sequence, fetching unpaid invoices, and subscribing to webhook notifications at Chaserhq's developer resources page: Chaserhq's API documentation (https://www.chaserhq.com/api).

10 Chaserhq alternatives

- Satago — AR automation with factoring options and credit risk checks

- Invoiced — Billing and collections platform with advanced payment plans and integrations

- HighRadius — Enterprise receivables automation and cash application for large organizations

- Agicap — cashflow management and forecasting with collections integrations

- Sage Intacct Receivables — ERP receivables module with automation in Sage ecosystem

- QuickBooks Online (plus collections add-ons) — accounting platform with available AR automation apps

- Xero (with AR apps) — cloud accounting with partner apps for automated chasing

- Collect! — collections management and debtor tracking for SMBs

- Stripe Billing — recurring payments and invoicing with built-in dunning features

- FreeAgent (with add-ons) — small-business accounting with optional chasing workflows

Paid alternatives to chaserhq

- Satago: cloud AR automation that pairs reminders with optional invoice financing; good for SMEs that want combined credit and collections capabilities.

- Invoiced: comprehensive billing platform that includes dunning, payment plans and automated payment reconciliation.

- HighRadius: enterprise-grade receivables automation focused on large volume cash application, dispute resolution and credit-to-cash workflows.

- Sage Intacct Receivables: part of a broader ERP offering; it provides integrated receivable automation inside Sage’s finance platform.

- Stripe Billing: while not a dedicated collections platform, Stripe’s dunning and subscription recovery tools handle many automated retry and notification scenarios for payment recovery.

Open source alternatives to chaserhq

- ERPNext: open-source ERP with receivables and invoice management; requires configuration and hosting but supports custom automation.

- Odoo (Community): modular ERP with invoicing and accounting modules that can be extended to automate reminders via community apps.

- Invoice Ninja (self-hosted): invoicing platform with basic recurring invoice and reminder capabilities available in self-hosted editions.

- Dolibarr: open-source ERP/CRM with invoicing and basic automated reminders when self-hosted and configured.

Frequently asked questions about Chaserhq

What is Chaserhq used for?

Chaserhq is used for automated accounts-receivable follow-up and collections. Finance teams and accountants use it to schedule and send reminders, attach payment links, escalate overdue invoices and measure recovery performance. The tool reduces manual chasing and centralizes debtor communications and audit trails.

Does Chaserhq integrate with Xero and QuickBooks?

Yes, Chaserhq integrates with major cloud accounting systems such as Xero and QuickBooks Online. These integrations allow automatic import of invoices, payment reconciliation and status updates so reminders reflect the current accounting data. Additional connectors and third‑party integrations are available via the platform or Zapier.

How much does Chaserhq cost per user?

Chaserhq starts at $39/month for the Starter plan when billed monthly, with Professional and Enterprise tiers available for larger teams and more advanced needs. Pricing can be based on number of companies, debtors or automation volume rather than per-seat in some contracts, so check the published pricing for the most accurate per-user equivalent.

Is there a free version of Chaserhq?

No, Chaserhq does not provide a permanent free tier; it typically offers a free trial for evaluation. The core functionality requires a paid subscription after the trial period; small practices can use the trial to confirm fit before committing to a paid plan.

Can Chaserhq send SMS or physical letters?

Yes, Chaserhq supports multiple communication channels depending on plan and region, typically including email and optionally SMS or printed letter services via partners. Channel availability and costs depend on configuration and local regulations; confirm supported channels for your country in the product documentation.

What reporting and analytics does Chaserhq provide?

Chaserhq provides dashboards and reports on aging, days sales outstanding (DSO), recovery rates, and performance of chase sequences. These reports help finance managers identify chronic late payers, measure the success of reminder templates and prioritize collections activity.

Can Chaserhq handle multiple client accounts for accountants?

Yes, Chaserhq supports multi-entity management for accounting practices and agencies. Accountants can manage multiple client ledgers from a single dashboard, apply client-specific templates, and segregate data access between clients.

How secure is Chaserhq with financial data?

Chaserhq uses industry-standard security measures, including encrypted data transport and role-based access controls. Enterprise plans commonly include additional controls such as SSO, data residency options and audit logs; review Chaserhq's security documentation for full compliance details.

Does Chaserhq provide APIs for custom automation?

Yes, Chaserhq offers a REST API and webhooks to integrate with ERPs, CRMs and BI systems. The API supports actions such as fetching invoices, triggering chase sequences, and subscribing to payment or status change events for automated workflows.

How long does implementation take for Chaserhq?

Implementation time varies but typically ranges from a few days to several weeks depending on the number of integrations and custom workflows required. A small business connecting a single accounting package can usually be operational in a few days, while multi-entity setups with custom templates, SSO and data migration require more planning and professional services.

chaserhq careers

Chaserhq maintains a careers page where openings for product, engineering, sales and customer-success roles are posted. Roles often emphasize experience in SaaS, payments, and finance automation. Candidates can expect remote and hybrid roles depending on the company’s hiring policy; check Chaserhq's careers listing for current vacancies and application instructions at https://www.chaserhq.com/careers.

chaserhq affiliate

Chaserhq runs partner and referral programs for accountants, bookkeepers and technology partners to earn commissions or recurring referral fees. These affiliate or partner schemes typically include onboarding support, co-branded materials, and partner portals to track referrals. For details on partnership criteria and commission structures, look for Chaserhq's partner program page at https://www.chaserhq.com/partners.

Where to find chaserhq reviews

Find user reviews of Chaserhq on software review platforms and accounting community forums. Common places to consult include financial-software review sites, app marketplaces linked to Xero and QuickBooks, and accounting association forums. For verified reviews and case studies, review the customer stories and testimonials available on Chaserhq's website at https://www.chaserhq.com/customers and third-party review sites for independent feedback.