Expensify

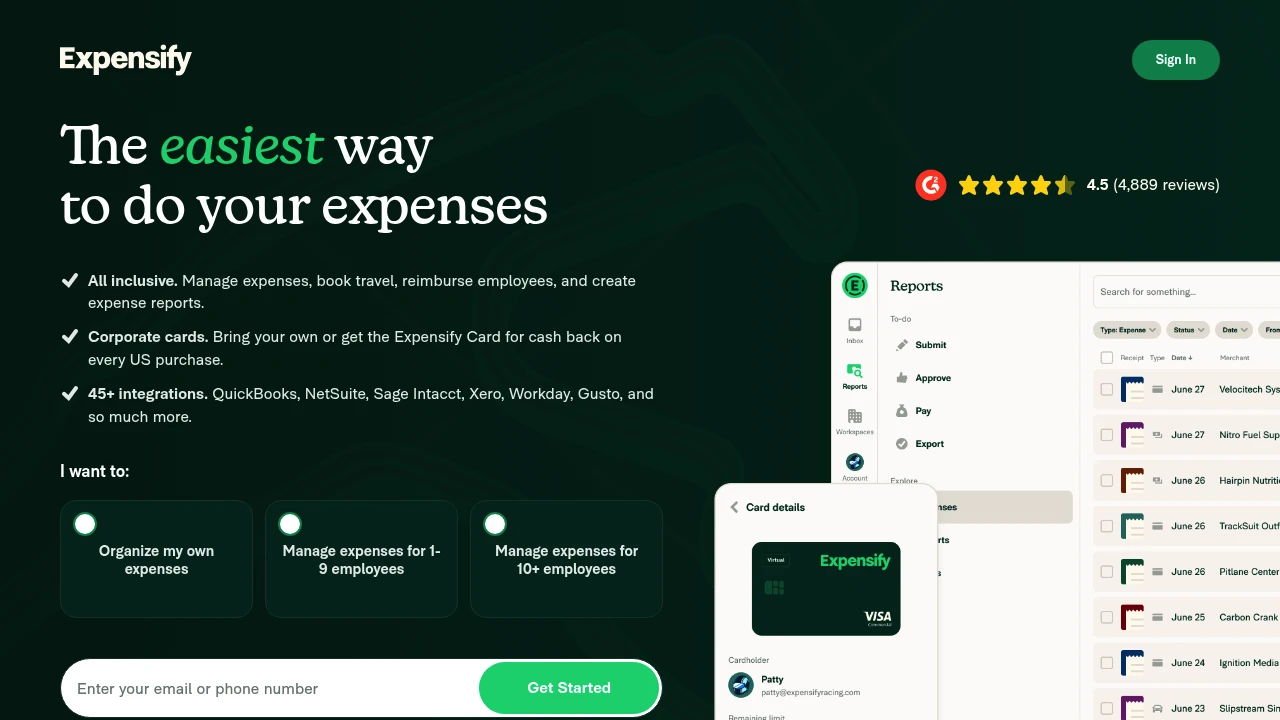

Expense reporting and corporate card reconciliation software for individuals, small teams, and enterprises that automates receipt capture, approval workflows, and accounting exports.

What is expensify

Expensify is expense management software that automates receipt capture, expense report creation, and accounting reconciliation for individuals, small businesses, and enterprises. The platform combines mobile receipt scanning with backend policy enforcement, corporate card reconciliation, and integrations to accounting systems so finance teams spend less time processing expenses and more time on controls and analysis.

Expensify is used by individual users who need a simple way to track receipts and by larger organizations that require automated approvals, enforceable expense policies, and tight integrations with ERP and accounting platforms. It supports both employee-submitted expenses and company card feeds, and includes tools for corporate card reconciliation and real-time expense monitoring.

The product is offered as a cloud service with mobile apps for iOS and Android, a web console for finance teams, and APIs for automation and custom integrations. Expensify emphasizes automatic receipt OCR, policy-driven approvals, and exports to common accounting packages.

Expensify features

What does expensify do?

Expensify captures receipt data, classifies expenses, and converts individual receipts into structured expense items automatically using OCR and machine learning. Users can snap a photo of a receipt with the mobile app and Expensify will extract merchant, date, amount, and category information and attach it to an expense record.

The platform enforces expense policies through rules and automated approvals, including out-of-policy flags, automatic policy-based approval routing, and required fields enforcement. This reduces manual review work by finance teams and helps ensure compliance with corporate spending rules.

Expensify connects to corporate card feeds and bank feeds to match corporate card transactions with receipts and employee-submitted expenses, enabling reconciliation and clearing of card statements. It also provides reporting, spend analytics, and accounting exports to systems like QuickBooks, Xero, NetSuite, and ERP platforms.

Additional features include mileage tracking, per-diem support, multi-currency handling, receipt forwarding via email, bulk processing tools for finance teams, and admin controls for user provisioning and role-based permissions.

Expensify pricing

Expensify offers these pricing plans:

- Free Plan: $0/month for individual users with basic receipt capture and expense submission

- Team: $5/month per active user with automated approvals, corporate card reconciliation, and basic integrations

- Corporate / Control: $9/month per active user with advanced policy controls, bill pay, and priority support

- Enterprise: Custom pricing for large organizations with SSO, advanced security, dedicated onboarding, and custom integrations

Check Expensify's current pricing for the latest rates and enterprise options.

How much is expensify per month

Expensify starts at $0/month for individual users, while paid plans for teams typically begin at $5/month per active user when billed monthly. The monthly rate varies based on active-user billing models (you often pay only for users who submit or approve expenses in a billing period) and extra services like corporate card reconciliation or bill pay.

Monthly billing options and promotional discounts are sometimes available; larger organizations commonly negotiate annual or volume-based pricing through the Enterprise plan.

How much is expensify per year

Expensify costs about $60/year per user for a plan that is billed at $5/month per user when paid annually, and roughly $108/year per user for a $9/month per user tier if billed annually. Exact annual billing discounts and contract terms depend on the plan chosen and any negotiated enterprise agreement.

For accurate annual totals and volume discounts, check Expensify's current pricing or contact their sales team.

How much is expensify in general

Expensify pricing ranges from $0 to $9+/month per user. Individual users can use the free tier for basic receipt capture and reporting, small teams typically start in the mid-single-digit per-user-per-month range, and feature-rich business plans with advanced controls or enterprise support are priced higher or quoted individually.

Total cost also depends on add-ons such as corporate card reconciliation, bill pay services, active-user billing, and optional implementation or training services. Organizations should model average monthly active users and expected add-ons to estimate annual spend.

What is expensify used for

Expensify is used primarily for expense reporting, receipt capture, and corporate card reconciliation. Employees use the mobile app to take photos of receipts or forward digital receipts, which are then converted into expense line items that can be submitted for approval. This speeds up reimbursement cycles and reduces manual data entry.

Finance teams use Expensify to enforce spend policies, route approvals, and reconcile corporate card statements. The platform helps close the loop between card transactions and receipts, reducing unmatched-card liabilities and simplifying accounting reconciliations at month end.

Organizations also use Expensify for travel-related expense management, mileage tracking, and per-diem calculations. Its exports to accounting systems and integrations with payroll or AP make it suitable for companies that want to automate bookkeeping and reimbursement workflows.

Expensify is often selected by businesses that need a lightweight, mobile-first expense workflow with sufficient controls for compliance, plus the ability to integrate smoothly with their existing accounting stack.

Pros and cons of Expensify

Pros:

- Automated receipt OCR and smart scanning greatly reduce manual entry time for employees and finance teams.

- Policy enforcement: configurable rules and automatic approval routing reduce out-of-policy spend and manual intervention.

- Corporate card reconciliation: automated matching of card feeds to receipts streamlines month-end close.

- Strong integrations with accounting systems such as QuickBooks, Xero, and NetSuite simplify bookkeeping.

Cons:

- Pricing based on active users can be confusing for organizations that prefer a flat per-seat license model.

- Advanced features and enterprise-level controls require higher-tier plans or custom contracts, which can raise total cost.

- Companies with complex multi-entity accounting structures or highly customized ERP setups may need additional integration work or middleware.

Operational considerations:

- Implementation and change management are required to get consistent receipt capture adoption across an organization; finance teams should plan for initial training and policy configuration.

- Data retention, export, and audit capabilities are mature, but organizations subject to strict regulatory regimes should evaluate compliance documentation and third-party audit reports.

Expensify free trial

Expensify offers a free entry-level experience for individuals and usually provides a time-limited trial or pilot options for teams to test paid features. The free tier allows receipt capture and basic expense tracking, which is useful for evaluating OCR accuracy and mobile workflow.

For teams, Expensify often supports a trial period on paid plans so finance teams can test integrations, policy enforcement, and corporate card feeds before committing. Trials typically allow administrators to configure rules and run a pilot for a subset of users to validate reconciliation and accounting exports.

When planning a trial, prepare sample receipts, corporate card feeds, and a test accounting environment to validate exports. Use the trial to confirm reporting, approval routing, and integrations behave as expected before rolling out company-wide.

Is expensify free

Yes, Expensify offers a free plan for individual users that includes basic receipt capture, expense submission, and limited reporting. The free tier is suitable for sole proprietors and individuals who only need receipt organization and occasional reporting.

Paid tiers are needed for features like corporate card reconciliation, advanced policy controls, bill pay, and enterprise-grade support.

Expensify API

Expensify provides an API and developer resources for automating user provisioning, expense submission, report approval, and custom integrations. The API supports actions such as creating and submitting expenses, retrieving reports, and managing users and policies.

Common integration patterns include direct accounting exports, automated card feed ingestion, and webhooks for status changes (for example, when a report is approved or reimbursed). Expensify also supports file exports and CSV/Excel downloads for cases where direct integration is not possible.

Developers can find technical details, request examples, and SDK guidance in the Expensify developer documentation. For custom integrations or high-volume automation, enterprise customers can work with Expensify’s professional services or use middleware platforms to connect Expensify to ERPs and payroll systems.

See the Expensify developer documentation for API endpoints, authentication methods, and sample code.

10 Expensify alternatives

- SAP Concur — Enterprise-grade travel and expense management with deep integration into SAP and large-scale global deployments.

- Zoho Expense — Expense tracking for small to mid-market companies with integrated travel and policy controls at a competitive price.

- Certify — Expense and travel solution focused on mid-market organizations with strong analytics and policy management.

- Brex — Corporate card and spend management platform that combines card issuance with expense controls and automation.

- Ramp — Spend management and corporate card platform that emphasizes savings, controls, and automated card reconciliation.

- Divvy — Budgeting and expense platform integrated with corporate cards for real-time spend control (now part of Brex in some markets).

- SAP — (via SAP’s broader financial products) offers expense modules as part of larger ERP suites for organizations already using SAP.

- QuickBooks Online — While primarily accounting software, QuickBooks includes expense capture and integrates with several expense tools for SMBs.

- FreshBooks — Invoicing and expense features suitable for freelancers and small businesses requiring simplified expense tracking.

- Fyle — Expense management focused on automation, card reconciliation, and enterprise integrations.

Paid alternatives to Expensify

- SAP Concur: Enterprise travel and expense platform with global support, travel booking, and deep ERP integrations; typically priced for large organizations.

- Zoho Expense: Lower-priced option for SMBs with good automation, approvals, and integration with the Zoho suite and other accounting systems.

- Certify: Mid-market expense management with automated approval workflows, reporting, and support for corporate cards.

- Brex: Card-first spend management with built-in controls, real-time spend insights, and automated expense workflows.

- Ramp: Emphasizes spend optimization, free software model with interchange economics, and strong reporting and reconciliation features.

- Fyle: Strong automation capabilities, designed for enterprises that need flexible policy controls and API-first integrations.

Open source alternatives to Expensify

- Firefly III: Personal finance manager with expense tracking, budgeting, and reporting; self-hosted and suitable for technically capable small teams or individuals.

- ERPNext: Open-source ERP that includes expense claim modules, accounting, and reporting; suitable for organizations willing to self-host and customize workflows.

- GnuCash: Double-entry accounting software with expense tracking for small businesses and individuals; best for organizations that want local desktop control.

- LedgerSMB: Open-source accounting system with modules for expense tracking and financial reporting; requires technical setup and maintenance.

Frequently asked questions about Expensify

What is Expensify used for?

Expensify is used for expense management and receipt capture. The platform automates receipt scanning, expense report creation, and corporate card reconciliation, allowing employees to submit expenses via mobile and finance teams to enforce policies and export accounting data.

Does Expensify integrate with QuickBooks?

Yes, Expensify integrates with QuickBooks Online and QuickBooks Desktop. Integrations let you export expense reports, post expenses to the appropriate accounts, and sync vendor and customer data to reduce manual journal entries.

How much does Expensify cost per user?

Expensify starts at $0/month for individual users and typically around $5/month per active user for basic team plans, with higher tiers (around $9/month per active user) for advanced controls; enterprise pricing is quoted per contract. Exact pricing depends on billing frequency and selected features.

Is there a free version of Expensify?

Yes, Expensify offers a free plan for individuals that includes basic receipt capture and expense submission. Teams and businesses will likely need paid plans for corporate card reconciliation and policy enforcement.

Can Expensify match corporate card transactions to receipts?

Yes, Expensify supports corporate card reconciliation. The system ingests card feeds, attempts to match transactions with submitted receipts automatically, and flags unmatched items for review by finance.

Does Expensify have receipt OCR and automatic categorization?

Yes, Expensify includes OCR-based receipt scanning. The mobile app extracts merchant, date, amount, and other fields, applies merchant matching and automated categorization rules to reduce manual data entry.

Can Expensify handle international and multi-currency expenses?

Yes, Expensify supports multi-currency expenses. It records foreign currency amounts, usually stores original currency and converted home currency values, and supports exchange rates for correct accounting and reimbursement.

Does Expensify provide an API for integrations?

Yes, Expensify provides an API and developer documentation. The API supports expense creation, report retrieval, user management, and webhook notifications for automated workflows and custom integrations.

How secure is Expensify?

Expensify implements industry-standard security measures. The platform uses encryption in transit, role-based access controls, and supports single sign-on (SSO) for enterprise customers; organizations should review Expensify’s security and compliance documentation for specific certifications and controls.

How does Expensify reimburse employees?

Expensify supports reimbursement workflows and can integrate with payroll or direct deposit partners. Submitted and approved expenses can be exported to accounting or payroll systems, and some plans offer bill pay or reimbursement services for direct payouts.

expensify careers

Expensify maintains a careers site that lists open roles across product, engineering, finance, and customer-facing teams. Job listings typically describe required skills, role responsibilities, and whether a role is remote or office-based. Candidates can review culture notes and employee testimonials on the company careers pages.

Applicants should prepare examples of prior work in finance, SaaS product development, or support for cloud accounting tools, depending on the role. For engineering and product roles, familiarity with APIs, integrations, and mobile-first development is often expected.

For current openings and application details, see Expensify Careers.

expensify affiliate

Expensify runs partner and reseller programs for accountants, bookkeepers, and software resellers who want to refer clients or embed expense workflows into broader service offerings. Partners may receive referral commissions, co-marketing resources, and technical integration support.

Accounting firms and resellers typically integrate Expensify into their existing service stack to reduce client bookkeeping overhead and provide a streamlined expense-to-accounting workflow. If you run a referral or integration business, contact Expensify’s partner team to learn about program details and eligibility.

Find partner information on the Expensify partners page.

Where to find expensify reviews

Independent user reviews and ratings for Expensify are available on software review sites and app stores. View user feedback and detailed reviews on platforms such as G2, Capterra, and TrustRadius to compare feature scores, customer comments, and common pros/cons.

Read customer reviews and ratings on the Expensify listing on G2 or check feedback on Capterra’s Expensify reviews. App store reviews for the mobile apps can also provide insight into OCR accuracy and mobile usability.